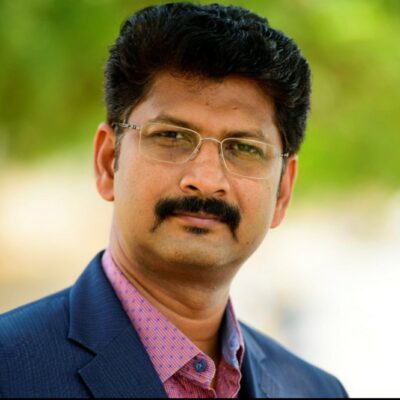

Vivek Tripathi, Head of Human Resources, AU Small Finance Bank talks about Planet First – AU Green Fixed Deposit and its impact on investors, in an interaction with ESG Times.

AU Small Finance Bank (AU SFB), India’s largest SFB, introduced its first Green Fixed Deposit in October 2023, called Planet First – AU Green Fixed Deposit, purposefully designed to allocate its entire proceeds to support renewable and green projects such as solar power, wind power and electric mobility solutions.

Vivek Tripathi, Head of Human Resources, AU Small Finance Bank talks about Planet First – AU Green Fixed Deposit and its impact on investors, in an interaction with ESG Times.

Excerpts from the interview:

What distinguishes AU Small Finance Bank’s Green Fixed Deposit from traditional fixed deposits?

The primary difference lies in the deployment of funds raised through the Green FD route. While funds raised through regular FDs can be deployed in any sector, funds raised from green deposits would only be utilized in financing/lending to ‘Green Assets.’ Green assets would comprise renewable energy, clean transportation, and other environmentally friendly endeavours aligned with RBI guidelines. AU Bank’s Green FD is named Planet First – AU Green Fixed Deposits, reflecting our ethos of responsible banking and sustainability.

How does the Green Fixed Deposit contribute to supporting renewable and green projects?

The funds raised through green deposits will be used to finance renewable projects such as the PM-KUSUM scheme and other commercial and industrial renewable projects. Lending towards green projects will also include clean transportation infrastructure and the e-mobility sector. Green deposits will contribute to achieving the Net Zero target by 2070 and the Panchamrit Goals of our country.

What are some examples of the types of projects funded by AU SFB’s Planet First – AU Green Fixed Deposit?

Planet First – AU Green FD funds will be invested in projects such as renewable energy, clean transportation, green building projects, sustainable agriculture, and sustainable water and waste management projects. These projects are aligned with RBI guidelines.

Can you explain the minimum investment requirement and interest rate offered by the Green Fixed Deposit?

The Planet First – AU Green Fixed Deposit offers an interest rate of up to 8.5%, depending on the maturity tenure. The minimum investment requirement is only ₹5,000, kept modest to attract a larger pool of customers.

How can existing and new customers of AU SFB open their Green FD accounts?

Existing and new customers can avail of green deposits through multiple channels, including the AU 0101 App, Video Banking, Net Banking, and Branch Banking.

What regulatory framework does AU SFB’s Green Fixed Deposit adhere to, and why is it significant?

Planet First – AU Green Fixed Deposit is fully compliant with the RBI Green Deposit Guidelines. This compliance is significant as adhering to the RBI guidelines provides necessary guardrails and a structured framework around green deposits, including their allocation, temporary parking of leftover funds, and third-party verification. The RBI framework is robust and ensures that there is no ‘greenwashing’.

What options are available to customers in terms of interest payment choices and tenures for the Green Fixed Deposit?

Customers can choose interest payment options and tenures based on AU SFB’s offerings, that may align with their preferences. Details may be referred to our website https://www.aubank.in/interest-rates/green-fd-interest-rates.

What’s the total green portfolio AU Small Finance allocated for sustainable credit?

We are currently consolidating the data and will disclose the details in our upcoming annual or integrated reports.

How was the reception towards the GFD that was launched in October? Did it make a considerable impact on the investors?

We launched on October 25th, 2023, and have received a positive reception. All stakeholders, including customers and investors, have been impacted positively. Customers are keen to contribute to the green & sustainable development of the nation and the entire planet.

What’s the maximum green loan size AU allocates per applicant? Is there any upper limit?

AU SFB allocates green loans according to maximum limit protocols, following normal lending practices.

How can the GFD Investor ensure the deposited money is used towards green loans? What kind of transparency does the bank provide in this regard?

The deployment of funds raised through the Green FD route and their impacts will be disclosed in our annual report, in line with the annexure provided by RBI. The annual report will contain transparent details, including third-party assurance of fund utilization to ensure full compliance with RBI guidelines.